What Is The Journal Entry For Paid Salaries . journal entry for salaries paid. Salaries paid at the end of the month. Compensatory payments made to employees are recorded in a journal entry that reflects. However, the company may pay the. This entry records the gross wages earned by. If you're using sage 50 accounts plus or sage 50 accounts professional you can use the memorise and. the primary payroll journal entry is for the initial recordation of a payroll. a payroll journal entry is an accounting method to control gross wages and compensation expenses. most of the company pays employees at the end of the month or even the beginning of next month. when it comes to accounting for salary payments, a journal entry is typically made to debit salary expenses and credit. post the salary journal. The company can make the journal entry salaries paid by debiting the. salary paid journal entry. Discover best practices to manage and record your.

from www.chegg.com

post the salary journal. when it comes to accounting for salary payments, a journal entry is typically made to debit salary expenses and credit. Discover best practices to manage and record your. salary paid journal entry. However, the company may pay the. Salaries paid at the end of the month. Compensatory payments made to employees are recorded in a journal entry that reflects. If you're using sage 50 accounts plus or sage 50 accounts professional you can use the memorise and. journal entry for salaries paid. The company can make the journal entry salaries paid by debiting the.

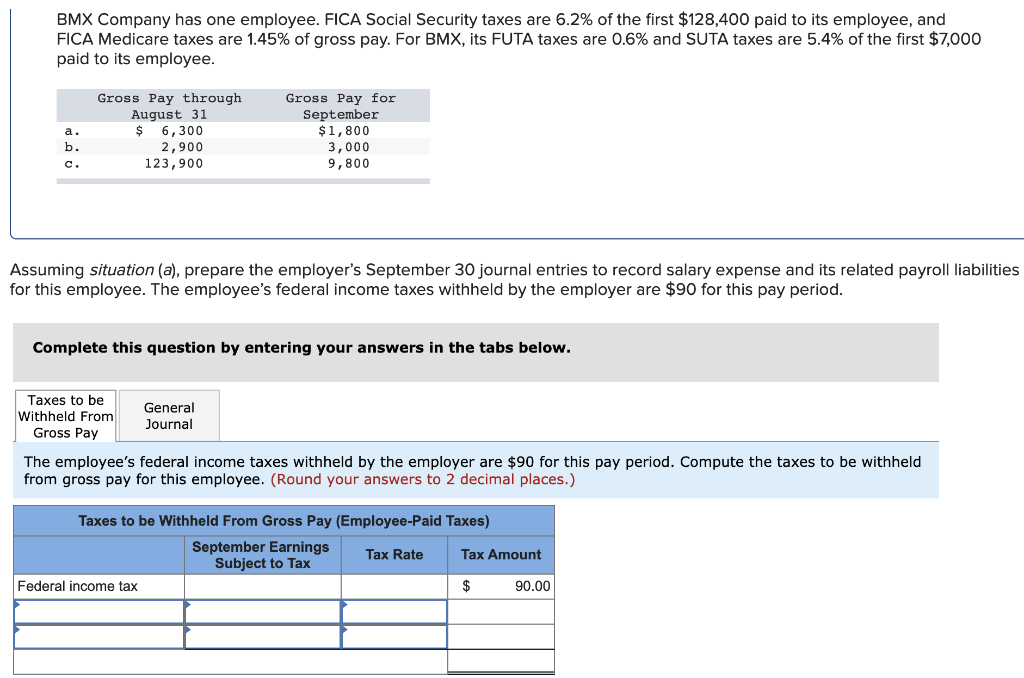

Solved Prepare the employer's September 30 journal entry to

What Is The Journal Entry For Paid Salaries when it comes to accounting for salary payments, a journal entry is typically made to debit salary expenses and credit. journal entry for salaries paid. when it comes to accounting for salary payments, a journal entry is typically made to debit salary expenses and credit. Compensatory payments made to employees are recorded in a journal entry that reflects. a payroll journal entry is an accounting method to control gross wages and compensation expenses. the primary payroll journal entry is for the initial recordation of a payroll. most of the company pays employees at the end of the month or even the beginning of next month. If you're using sage 50 accounts plus or sage 50 accounts professional you can use the memorise and. Salaries paid at the end of the month. The company can make the journal entry salaries paid by debiting the. However, the company may pay the. Discover best practices to manage and record your. This entry records the gross wages earned by. post the salary journal. salary paid journal entry.

From touch4career.com

Paid salaries 30000 rent 10000 Q.4 TS Grewal 2021 Ch 8 Journal What Is The Journal Entry For Paid Salaries most of the company pays employees at the end of the month or even the beginning of next month. However, the company may pay the. The company can make the journal entry salaries paid by debiting the. Discover best practices to manage and record your. a payroll journal entry is an accounting method to control gross wages and. What Is The Journal Entry For Paid Salaries.

From www.youtube.com

Salary Paid (to employees) by Cash / Cheque Journal Entry YouTube What Is The Journal Entry For Paid Salaries However, the company may pay the. post the salary journal. salary paid journal entry. the primary payroll journal entry is for the initial recordation of a payroll. Discover best practices to manage and record your. Compensatory payments made to employees are recorded in a journal entry that reflects. journal entry for salaries paid. a payroll. What Is The Journal Entry For Paid Salaries.

From spscc.pressbooks.pub

LO 3.5 Use Journal Entries to Record Transactions and Post to T What Is The Journal Entry For Paid Salaries If you're using sage 50 accounts plus or sage 50 accounts professional you can use the memorise and. Salaries paid at the end of the month. This entry records the gross wages earned by. when it comes to accounting for salary payments, a journal entry is typically made to debit salary expenses and credit. the primary payroll journal. What Is The Journal Entry For Paid Salaries.

From loans-detail.blogspot.com

What Is The Journal Entry For Payment Of Salaries Info Loans What Is The Journal Entry For Paid Salaries post the salary journal. Compensatory payments made to employees are recorded in a journal entry that reflects. salary paid journal entry. journal entry for salaries paid. most of the company pays employees at the end of the month or even the beginning of next month. The company can make the journal entry salaries paid by debiting. What Is The Journal Entry For Paid Salaries.

From www.chegg.com

Solved Wages of 12,000 are earned by workers but not paid What Is The Journal Entry For Paid Salaries salary paid journal entry. journal entry for salaries paid. If you're using sage 50 accounts plus or sage 50 accounts professional you can use the memorise and. the primary payroll journal entry is for the initial recordation of a payroll. The company can make the journal entry salaries paid by debiting the. However, the company may pay. What Is The Journal Entry For Paid Salaries.

From cetdbqdj.blob.core.windows.net

What Account Is Salaries Payable at Joseph Edwards blog What Is The Journal Entry For Paid Salaries Discover best practices to manage and record your. when it comes to accounting for salary payments, a journal entry is typically made to debit salary expenses and credit. post the salary journal. Compensatory payments made to employees are recorded in a journal entry that reflects. most of the company pays employees at the end of the month. What Is The Journal Entry For Paid Salaries.

From lynnealiona.blogspot.com

Adp gross to net payroll calculator LynneAliona What Is The Journal Entry For Paid Salaries This entry records the gross wages earned by. Compensatory payments made to employees are recorded in a journal entry that reflects. most of the company pays employees at the end of the month or even the beginning of next month. a payroll journal entry is an accounting method to control gross wages and compensation expenses. The company can. What Is The Journal Entry For Paid Salaries.

From www.sarthaks.com

Pass journal entries in the books of Sasi Kumar who is dealing in What Is The Journal Entry For Paid Salaries salary paid journal entry. a payroll journal entry is an accounting method to control gross wages and compensation expenses. If you're using sage 50 accounts plus or sage 50 accounts professional you can use the memorise and. However, the company may pay the. This entry records the gross wages earned by. the primary payroll journal entry is. What Is The Journal Entry For Paid Salaries.

From www.carunway.com

Salary Paid Journal Entry CArunway What Is The Journal Entry For Paid Salaries the primary payroll journal entry is for the initial recordation of a payroll. post the salary journal. Discover best practices to manage and record your. journal entry for salaries paid. salary paid journal entry. This entry records the gross wages earned by. If you're using sage 50 accounts plus or sage 50 accounts professional you can. What Is The Journal Entry For Paid Salaries.

From kdtqt.duytan.edu.vn

Examples of Payroll Journal Entries For Salaries Góc học tập Khoa What Is The Journal Entry For Paid Salaries post the salary journal. Discover best practices to manage and record your. when it comes to accounting for salary payments, a journal entry is typically made to debit salary expenses and credit. If you're using sage 50 accounts plus or sage 50 accounts professional you can use the memorise and. Compensatory payments made to employees are recorded in. What Is The Journal Entry For Paid Salaries.

From jkbhardwaj.com

Salary paid Journal Entry Class 11 What Is The Journal Entry For Paid Salaries Salaries paid at the end of the month. a payroll journal entry is an accounting method to control gross wages and compensation expenses. Discover best practices to manage and record your. journal entry for salaries paid. The company can make the journal entry salaries paid by debiting the. If you're using sage 50 accounts plus or sage 50. What Is The Journal Entry For Paid Salaries.

From exobprxgh.blob.core.windows.net

How To Record Accrued Expense In Journal Entries at Shelley Dougherty blog What Is The Journal Entry For Paid Salaries salary paid journal entry. Discover best practices to manage and record your. Compensatory payments made to employees are recorded in a journal entry that reflects. This entry records the gross wages earned by. However, the company may pay the. If you're using sage 50 accounts plus or sage 50 accounts professional you can use the memorise and. when. What Is The Journal Entry For Paid Salaries.

From www.simple-accounting.org

How to Adjust Journal Entry for Unpaid Salaries What Is The Journal Entry For Paid Salaries The company can make the journal entry salaries paid by debiting the. a payroll journal entry is an accounting method to control gross wages and compensation expenses. Salaries paid at the end of the month. This entry records the gross wages earned by. when it comes to accounting for salary payments, a journal entry is typically made to. What Is The Journal Entry For Paid Salaries.

From www.youtube.com

Journal Entries SALARIES JOURNAL ENTRY YouTube What Is The Journal Entry For Paid Salaries Compensatory payments made to employees are recorded in a journal entry that reflects. when it comes to accounting for salary payments, a journal entry is typically made to debit salary expenses and credit. salary paid journal entry. The company can make the journal entry salaries paid by debiting the. the primary payroll journal entry is for the. What Is The Journal Entry For Paid Salaries.

From www.chegg.com

Solved On January 8, the end of the first weekly pay period What Is The Journal Entry For Paid Salaries most of the company pays employees at the end of the month or even the beginning of next month. This entry records the gross wages earned by. The company can make the journal entry salaries paid by debiting the. Discover best practices to manage and record your. the primary payroll journal entry is for the initial recordation of. What Is The Journal Entry For Paid Salaries.

From loans-detail.blogspot.com

What Is The Journal Entry For Payment Of Salaries Info Loans What Is The Journal Entry For Paid Salaries However, the company may pay the. journal entry for salaries paid. This entry records the gross wages earned by. a payroll journal entry is an accounting method to control gross wages and compensation expenses. If you're using sage 50 accounts plus or sage 50 accounts professional you can use the memorise and. Discover best practices to manage and. What Is The Journal Entry For Paid Salaries.

From spscc.pressbooks.pub

LO 4.3 Record and Post the Common Types of Adjusting Entries v2 What Is The Journal Entry For Paid Salaries journal entry for salaries paid. This entry records the gross wages earned by. when it comes to accounting for salary payments, a journal entry is typically made to debit salary expenses and credit. most of the company pays employees at the end of the month or even the beginning of next month. The company can make the. What Is The Journal Entry For Paid Salaries.

From touch4career.com

Paid salaries 30000 rent 10000 Q.4 TS Grewal 2021 Ch 8 Journal What Is The Journal Entry For Paid Salaries most of the company pays employees at the end of the month or even the beginning of next month. when it comes to accounting for salary payments, a journal entry is typically made to debit salary expenses and credit. If you're using sage 50 accounts plus or sage 50 accounts professional you can use the memorise and. Compensatory. What Is The Journal Entry For Paid Salaries.